|

|

|

Share Price |

1M |

3M |

12M |

CAGR2 |

YTD |

| USD Arbitrage Share Class |

290.4850 |

0.52 |

1.63 |

4.46 |

13.09 |

1.63 |

| EUR Arbitrage Share Class |

126.6341 |

0.42 |

1.18 |

2.97 |

6.08 |

1.18 |

| CHF Arbitrage Share Class |

127.0756 |

0.34 |

0.98 |

2.07 |

6.04 |

0.98 |

| GBP Arbitrage Share Class |

100.0000 |

- |

- |

- |

- |

- |

|

|

|

|

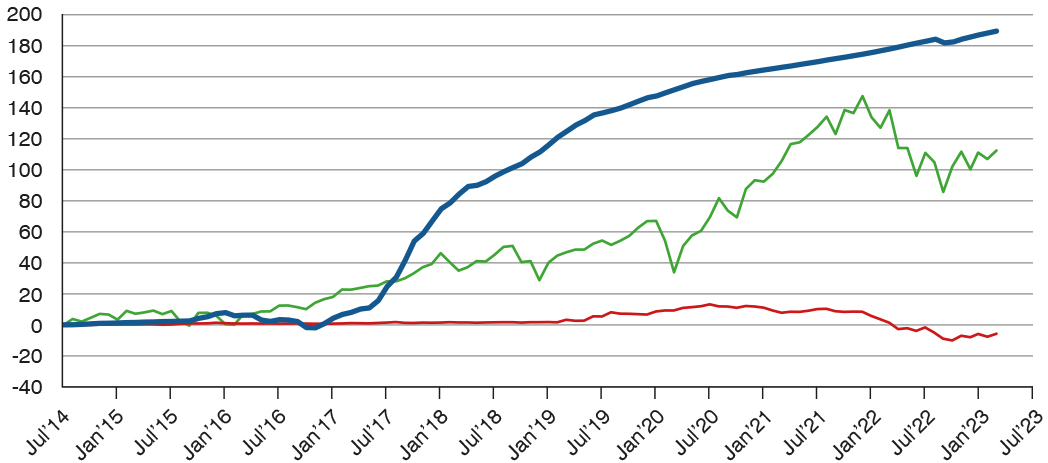

Performance Evolution - USD Arbitrage Class1 (%)

|

|

| |

|

USD Arbitrage Class

|

|

|

S&P 500

|

|

|

US Treasury Bond

|

|

|

|

|

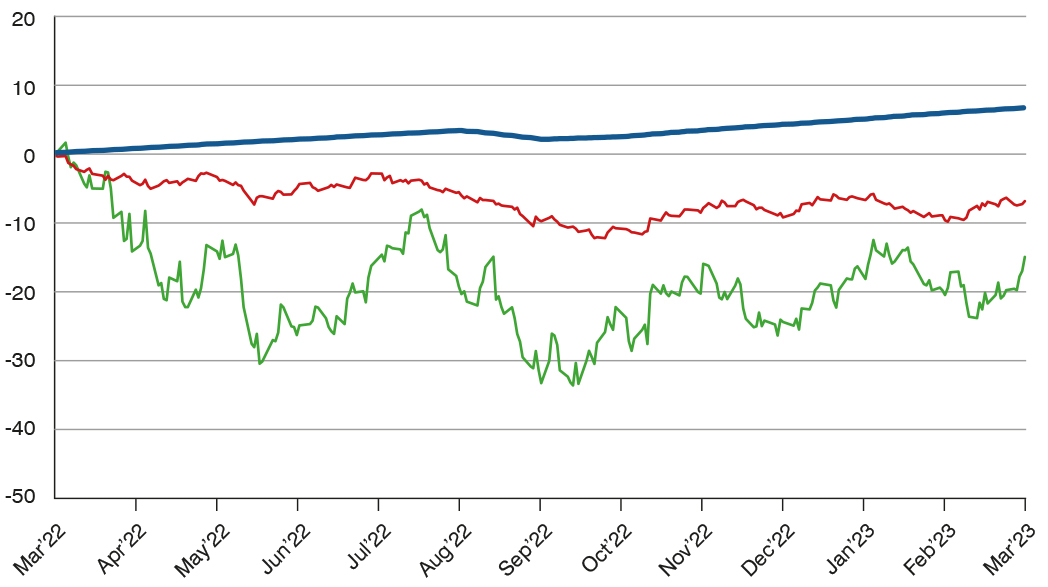

12 Month Performance Graph - USD Arbitrage Class1 (%)

|

|

| |

|

USD Arbitrage Class

|

|

|

S&P 500

|

|

|

US Treasury Bond

|

|

|

|

|

|

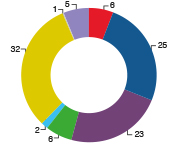

Insurance Linked Securities

|

|

Real Estate

|

|

|

Mutual Funds

|

|

Fixed Income

|

|

|

Asset Backed Securities

|

|

Foreign Exchange

|

|

Equity Investment

|

|

Cash

|

|

|

|

|

|

|

Key Performance Figures (%)

|

|

|

AUM

|

$19,489,054

|

|

|

Annualised Return

|

21.98

|

|

|

CAGR2

|

13.09 |

|

|

% of positive months

|

92.31 |

|

|

% of negative months

|

7.69

|

|

|

Standard Deviation

|

1.79

|

|

|

Sharpe Ratio

|

0.5370 |

|

|

Avg Monthly Return

|

1.05

|

|

|

Best Month

|

8.64

|

|

|

Worst Month

|

-3.75

|

|

|

|

|

|

1

Performance data quoted is net of fees.

2

Compound Annual Growth Rate.

|

|

|

|

Key Features

|

Fund Type

Open Ended Mutual Fund

|

|

Tax Reporting Status

The fund is registered with HMRC as an Approved Offshore Reporting Fund for all share classes

|

|

Launch Date

August 2014

|

|

Valuation Frequency

Monthly

|

|

Switching Fee

1.0%

|

|

Base Currency

USD

|

|

Share Class Currencies

USD, EUR, CHF or GBP

|

|

Dealing Day

First business day of each month

|

|

Minimum Subscription

USD100,000

|

|

Charges Information

|

Initial Charge

Nil

|

|

Management Charge

2% of GAV per annum

|

|

Performance Fee Charge

20% of new net highs of NAV

|

|

Investment Objectives

|

The investment objectives of Vita Nova Hedge Fund are to achieve long term capital growth by investing in asset classes where the investment strategy team can identify short to medium term investment opportunities with a focus on risk mitigation and liquidity management.

|

|

Investment Approach

|

The fund’s investment management team may rely on economic forecasts and analysis in respect of interest rate trends, macroeconomic developments, global imbalances, business cycles and other broad systemic factors to identify pricing weaknesses with the potential to strengthen given time.

As common with most hedge funds VNHF has a flexible investment mandate. The majority of the assets of VNHF are intended to be invested in arbitrage and or alpha investment opportunities and may take long and short positions in various equity, fixed income, currency, commodity, and futures markets.

The fund’s investment strategy team makes its investment decisions based on broad systemic factors that may lead to arbitrage and alpha opportunities in various markets based on macroeconomic and value principles.

Where the Manager identifies value opportunities it has the ability to use gearing to over invest wherever possible whilst preserving liquidity to afford relatively quick changes to the portfolio weighting and to take advantage of short term market trends and opportunities.

The base currency of the fund is USD and the fund therefor aims to achieve alpha in USD. The EUR, CHF and GBP share classes are hedged with the objective of delivering a similar performance trend in the currency of the share class.

Subject to the terms detailing in the Fund’s offering document, shareholders may manage their own currency risk exposure

by switching between the Arbitrage share classes

on each dealing.

|

|

|